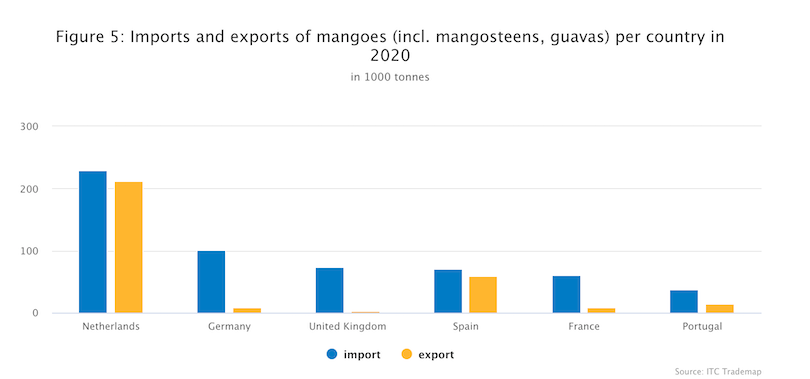

The Netherlands and Spain are the main players in Europe’s mango trade. The former has historically had a central role, but Spain is also gradually expanding its share of the trade (as well as its own output). The traded fruit mainly end up in Germany, United Kingdom, France and Portugal. While French and Portuguese consumers appreciate a good, tasty mango, the German and UK markets require higher standards in terms of certification.

Netherlands: chief trade hub for mangos

The Netherlands is the main trade hub for mango in Europe. It imports 33% of all mangos shipped to the continent and its imports (230 thousand tonnes) are almost identical to its exports (212 thousand tonnes). This confirms its key role in the redistribution of the mangos it imports. Most Netherlands mangos are re-exported to Germany (43%) and France (11%); the remainder are shared between the United Kingdom, Belgium, the Scandinavian countries and Switzerland.

Dutch traders purchase from a wide selection of suppliers. Most imports come from Brazil (89 thousand tonnes in 2020) and Peru (80 thousand tonnes), but thousands of tonnes are also sourced from countries such as Ivory Coast, Dominican Republic, Mali, Senegal, United States and Israel. Dutch traders try to satisfy demand all year round and sometimes include some of the more exotic mango varieties, such as Nam Dok Mai and Ataulfo, shipped by air.

The Netherlands itself is a medium-large market for mangos, which are sold in supermarkets and, more and more often, as fresh cut fruit. However, it is above all due to the challenges of procurement and its logistics experience that the Netherlands may retain its leading role in the import/export of mangos for many years to come.

Germany: the biggest destination market for mangos

Germany is the number one mango consumer country. It should therefore be considered one of the main destination countries, but only when procurement and food safety are properly managed. In 2020, Germany had an estimated mango consumption of 92 thousand tonnes (imports less exports).

Future developments of the German mango market depend on how supply and compliance are managed. Exporters have to consider strict procurement criteria. Lack of food safety and pesticide residues are crucial factors for supermarkets, while most consumers buy mangos on the basis of price and appearance. Flavour is not always the most immediate concern, but after a bad experience German consumers do not make repeat purchases. There is also a growing group of consumers who prefer organic mangos, even though they are more expensive. At present, Spain is one of the main suppliers of organic mangos. Supplying a product that comes up to Germany’s high standards and expectations can be a real challenge for exporters.

Most mangos imported into Germany pass through the Netherlands or are supplied by German importers who use Dutch logistics.

United Kingdom: convenience is the main consideration

Just behind Germany, the United Kingdom is Europe’s second largest importer of mangos. Almost 73 thousand tonnes were imported in 2020, with imports stable over the last five years in volume terms. Brexit (the United Kingdom’s exit from the EU) and the COVID-19 pandemic have certainly not acted in favour of demand for mangos.

Current developments concentrate above all on diversification, such as tree-ripened mango, premium mango, fresh cut mango and also on other added value products such as mango ice pops and ice creams. Another specific market segment is that for native origin mangos: the United Kingdom is a major customer for specific mango varieties from Pakistan and India, such as air-shipped Alphonso and Kesar mangos.

Pakistan and India are the third and fifth non-European mango suppliers, after Peru and Brazil. In 2019, Pakistan exported 8,500 tonnes to the United Kingdom and India 4,400 tonnes, while Peru and Brazil exported 14,600 and 11,700 tonnes respectively. However, native origin mango imports temporarily slumped by 40% in 2020 due to the reduction in the number of cargo flights from these countries. Only Brazil was able to increase its supply, to 17,400 tonnes, in 2020.

France: a market with potential for West Africa

The mango is a popular fruit in France, which could be a more interesting market for West African suppliers compared to other countries. However, consumers’ general preference for local summer fruit will always be a source of competition for mango imports.

In 2020, French mango imports only totalled 61 thousand tonnes, almost 10 thousand less than the previous year. In spite of this, France was Europe’s third largest consumer market. West Africa exports relatively high volumes of mangos to France. For example, Ivory Coast and Senegal exported 5,500 and 2,400 tonnes respectively to France in 2020, not much less than major suppliers such as Peru (18,400 tonnes), Spain (12 thousand tonnes) and Brazil (8,500 tonnes).

The favourite varieties are Kent and Keitt, the same as in the rest of Europe. However, Carrefour supermarkets also stock Amelie mangos from Burkina Faso and tree-ripened, air-shipped mangos, and not only for the high-end catering market. There are also opportunities in the organic segment, where sales have grown significantly.

There are good prospects for mangos from Ivory Coast, Senegal, Mali and Burkina Faso, Peru permitting. In fact, the South American country has made a forceful entry onto the market during the European winter season, and is in ever-increasing competition with the start of the West African season. Trade statistics indicate a 40% rise in imports from Peru between 2016 and 2020. However, France has a strong preference for locally grown fruit. This means that demand for mangos from neighbouring Spain will remain high, as will that for mangos of French origin.

Spain: one of the fastest-growing mango markets

Spain is one of the fastest-growing mango importers. With the increase in both production and exports, it is establishing itself as a mango trading hub. This means that it supplies fruit to various other destinations as well as the domestic market.

According to Spanish news outlets, Spain produced 28,276 tonnes of mangos in 2020, with Osteen the main variety. It is believed that Spanish consumption is on the increase but is still behind that of Germany and the United Kingdom in per capita terms.

Most of the Spanish crop is exported. Specifically, Spain exports more than the volume of its domestic production, adding between 20 and 30 thousand tonnes of re-exported mangos to this figure. This makes Spain the second-biggest mango trading hub after the Netherlands. Imports are expected to increase to meet local demand and complete the Spanish season. In 2020, the main suppliers were Brazil (43,700 tonnes) and Peru (16,300 tonnes), while Spain’s biggest export markets are Portugal (24,000 tonnes) and France (15,200 tonnes).

Portugal: the highest per capita consumption

Portugal is not a densely populated country, but it has the highest per capital consumption of mangos. An estimated net import volume of 22,700 tonnes (imports less exports) indicates that every member of the population consumes an average of 2.2 kilos a year. Spain is Portugal’s largest supplier by a considerable margin, followed by the Netherlands for re-exports and Brazil, which exports mangos both by sea and by air. Gaps in supply are mainly covered by mangos traded through the Netherlands. Portugal has strong links with Brazil, and offers only limited direct opportunities to suppliers from other regions.

It may be difficult to find Portuguese importers willing to do business with unknown sources of supply. Most of them prefer to continue with Spain, Brazil and the Netherlands. However, it could be worth exploring more direct trading opportunities, especially between the Spanish and Brazilian seasons.

These and other data will be discussed on 6 May in Rimini at the Tropical Fruit Congress organised by myfruit.it in association with Macfrut 2022.